best selling productsView More

Forex & Trading

Forex & Trading

Forex & Trading

Ecommerce

Internet Marketing

Internet Marketing

Basecamp Trading – Workshop Impulse Trading System ( Member )

Personal Development

KILOCOURSE SERVICE

HOW TO DELIVERY

After payment, We will send download link to your email within 5 – 10 minutes. In case of we are in relax. Please allow us max 6 – 8 hours to fullfil your orders.

RETURN POLICY

We will refund full amount with no questions ask if its our fault (Item’s not as description, Item is not full, Item’s not working the way it should…)

How To Pay

KiloCourse are using paypal for our auto-payment gateway. You can easily make purchase using Paypal account. For other method, please contact us

LIFETIME SUPPORT

Got a question? Look no further.

Browse our FAQs or send me message via email (Kilocourse@gmail.com)

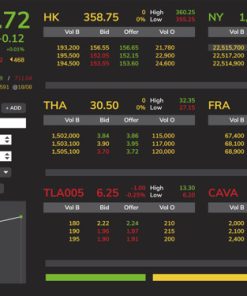

![Mike Aston – Learn To Trade [Stock Trading Course Trading Template]](https://kilocourse.net/wp-content/uploads/2019/07/mike-aston-learn-to-trade-stock-trading-course-trading-template-4-247x296.png)